Contracts are full of legal language that can make anyone’s eyes glaze over. But tucked into many agreements is a clause that can have serious financial consequences: the indemnification clause.

Whether you’re a business owner, freelancer, or professional signing contracts, it’s important to know what this clause means. In this post, we’ll break it down in plain English, using examples and analogies, so you can spot it, understand it, and know what to do about it.

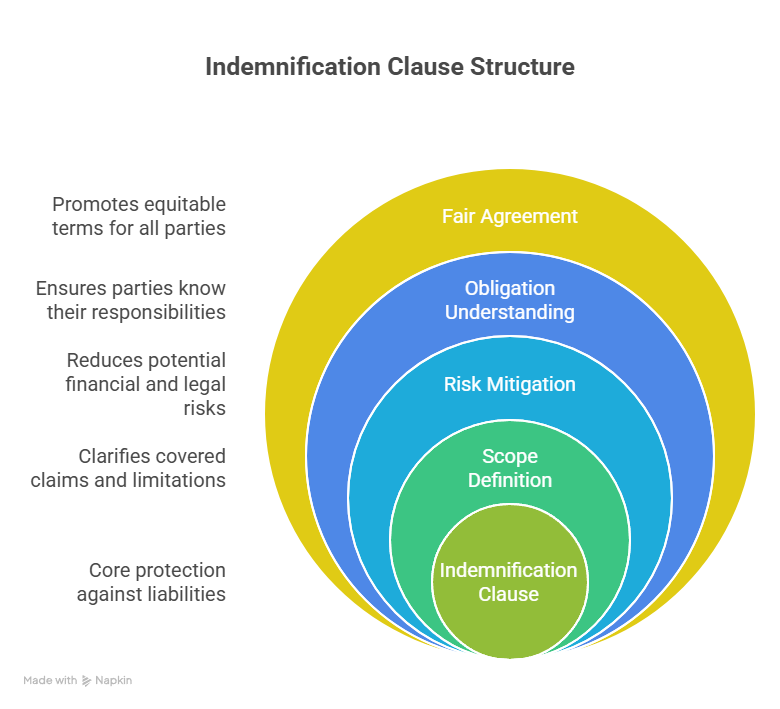

What Is an Indemnification Clause?

At its core, an indemnification clause is a promise: one party agrees to cover the losses, costs, or damages the other might face because of certain events.

Think of it as insurance written directly into a contract. If something goes wrong, the indemnifying party (the one making the promise) has to step in and protect the other party financially.

It shifts risk. Businesses use it to make sure that if a dispute, lawsuit, or claim arises, they’re not left holding the bag for something caused by the other party’s actions.

Indemnification can look different depending on which side of the table you’re on:

- If you’re the protected party: It’s a safety net. You don’t have to worry as much about lawsuits or claims arising from the other party’s mistakes.

- If you’re the indemnifying party: It can be risky. You could be on the hook for legal fees, damages, and settlements—sometimes in amounts much larger than the contract itself.

Imagine lending your car to a friend. If they promise to pay for any tickets or accidents that happen while driving, that’s indemnification. If they don’t, you could be the one stuck paying.

Common Examples of Indemnification Clauses

Indemnification clauses pop up in many different agreements. Here are some common scenarios:

- Service contracts: A graphic designer might agree to indemnify a client if their design accidentally infringes on someone else’s copyright.

- Vendor agreements: A supplier might indemnify a retailer if their defective product causes injury to customers.

- Software contracts: A software company often indemnifies users if the software infringes on a third party’s intellectual property.

- Employment contracts (rare but possible): Sometimes executives are promised indemnification if they’re sued for decisions they made in good faith while running the company.

For example, a freelance web developer signs a contract requiring them to indemnify a client for “any and all claims.” Later, a third party sues the client over something unrelated to the developer’s work. Because of the broad indemnification language, the developer could still be pulled in and forced to pay legal fees.

Types of Indemnification

Understanding the type of indemnification clause in your contract is crucial. Some are fair and balanced; others heavily favor one party.

a) Unilateral vs. Mutual

- Unilateral: One party bears the obligation (common when freelancers or vendors work with larger companies).

- Mutual: Both parties agree to indemnify each other, usually for issues under their own control. This is more balanced.

b) Scope (Broad vs. Limited)

- Broad indemnification: Covers “any and all claims” related to the agreement. Risky for the indemnifying party.

- Limited indemnification: Narrowly covers specific risks, like intellectual property claims or negligence. Safer and more reasonable.

c) Exclusions

Typical exclusions include:

- Negligence or misconduct by the protected party.

- Claims outside the scope of the contract.

- Damages caused by unforeseeable events (sometimes).

Things to Keep in Mind

Because indemnification clauses can dramatically shift financial risk, here’s what to do:

- Read carefully – Don’t skim. Look for phrases like “indemnify,” “hold harmless,” or “defend.”

- Ask: “What exactly am I covering?” – Is it only specific claims (like intellectual property issues), or “any and all” claims?

- Negotiate balance – Push for mutual indemnification or limit the scope. Example: “I’ll indemnify you for claims directly caused by my work, but not for issues beyond my control.”

- Cap your liability – Try to limit indemnification to a maximum amount, such as the total fees paid under the contract.

- Check your insurance – Professional liability or general business insurance may cover some indemnification risks—but not all. Don’t assume you’re covered.

Conclusion

Indemnification clauses may look like boring boilerplate, but they carry real weight. They decide who pays if something goes wrong, and the amounts involved can be massive.

For business owners, freelancers, and professionals, the takeaway is simple:

- Don’t skim over indemnification clauses.

- Understand whether you’re protected or exposed.

- Push for fair, balanced terms.

- When in doubt, get legal advice.

A few minutes of careful review before signing can save you years of financial and legal headaches later.